When considering treatment for substance abuse, one of your primary concerns may be the financial burden. You’re not alone – a 2019 survey found that 32% of Americans cited cost as a major barrier to seeking addiction treatment. Fortunately, insurance coverage for rehab has expanded significantly in recent years. The Mental Health Parity and Addiction Equity Act requires most health plans to cover substance abuse treatment at levels comparable to medical care. However, specifics vary widely between policies. This guide will help you understand what types of rehab are typically covered, including acute detox, residential programs, and outpatient therapy. Armed with this knowledge, you can make informed decisions about your path to recovery.

Together, let’s embrace the journey to recovery and the promise of a new beginning. Call us at (617) 917-3485 today or reach out online.

Why do Insurance Companies Deny Rehab?

Coverage Limitations

Insurance policies often impose limits on the scope and duration of covered addiction treatment services. According to the source, common reasons for denial include exceeding caps on inpatient days or outpatient visits, or seeking care from out-of-network facilities.

Medical Necessity Criteria

Insurers typically require a formal substance use disorder diagnosis to establish medical necessity for rehab. Treatment may be denied if it does not align with the insurer’s criteria for an appropriate level of care, such as intensive inpatient treatment versus outpatient services.

Prior Authorization Issues

Many plans mandate pre-approval or a referral from a primary care provider before covering addiction treatment. Failure to obtain proper prior authorization can result in claims being denied, even for medically necessary care.

Verification & Appeals

To maximize coverage, patients are advised to thoroughly understand their policy details, get pre-approval from insurers, and use in-network providers when possible. Those facing denial have the right to appeal through the insurer’s formal process.

While insurance barriers persist, options like sliding scale fees and state-funded programs offer alternative paths to making rehab more accessible for those struggling with substance abuse.

What is rehabilitation insurance?

Rehabilitation insurance, or rehab coverage, refers to the benefits provided by health insurance plans to help cover the costs of addiction treatment and recovery services. Many major insurance providers like Cigna, Aetna, and others are legally required to offer some level of coverage for substance abuse treatment, thanks to laws like the Affordable Care Act.

Scope of Coverage

- Inpatient rehab programs, including medically-supervised detox and residential treatment

- Outpatient treatment options like intensive outpatient programs (IOPs) and standard therapy

- Medication-assisted treatments (MAT) such as methadone, Suboxone, or Vivitrol

- Mental health services for co-occurring disorders like depression or anxiety

Verifying Your Benefits

The extent of coverage can vary significantly based on your specific insurance plan. To verify your benefits for addiction treatment, you can:

- Contact your insurance provider directly and provide details on the recommended care

- Work with an admissions team at a treatment center like Evoke Wellness who can check your policy for you

Understanding your deductibles, copays, and any coverage limits is crucial to maximizing your insurance benefits and minimizing out-of-pocket costs.

Expanding Access

Recent studies highlight the effectiveness of professionally-managed rehab programs, increasing long-term recovery rates by up to 60%. With rehabilitation insurance coverage, more individuals can access the comprehensive care needed to overcome addiction and achieve lasting sobriety.

Is alcoholism considered a pre-existing condition?

Alcoholism and Health Insurance

Alcoholism, or alcohol use disorder, is considered a pre-existing condition by most health insurance providers in the United States. According to the National Institute on Alcohol Abuse and Alcoholism, nearly 15 million adults aged 18 and older had Alcohol Use Disorder (AUD) in 2019. This chronic disease can have severe impacts on an individual’s physical and mental health, making it crucial to seek professional treatment.

Coverage and Limitations

Many health insurance plans cover some level of treatment for alcoholism, including detox, inpatient rehab, and outpatient therapy programs. However, the extent of coverage can vary greatly depending on the specific plan and the severity of the condition. As noted by the Substance Abuse and Mental Health Services Administration, some plans may require prior authorization or impose limitations on the duration or type of treatment covered.

Affordable Care Act and Parity

The Affordable Care Act (ACA) has played a significant role in improving access to addiction treatment services. Under the ACA, substance abuse treatment, including alcoholism, is considered an essential health benefit that must be covered by most insurance plans. Additionally, the Mental Health Parity and Addiction Equity Act (MHPAEA) requires that insurance coverage for mental health and substance abuse disorders be no more restrictive than coverage for medical and surgical services.

Seeking Assistance

If you or a loved one is struggling with alcoholism, it’s essential to understand your insurance coverage and explore all available treatment options. Many reputable treatment facilities, like Evoke Wellness at Cohasset, can assist you in navigating the insurance process and finding the appropriate level of care. Remember, seeking help is a courageous step towards recovery and a healthier life.

Types of addiction services covered by insurance:

Detoxification Programs

Many insurance plans cover the costs of medical detoxification to manage withdrawal symptoms safely. This first step of addiction treatment helps patients rid their bodies of substances under 24/7 medical supervision.

Inpatient/Residential Rehab

Inpatient or residential treatment programs are commonly covered for 28-90 days. These intensive programs provide counseling, therapy, life skills training, and peer support in a structured environment.

Outpatient Treatment

Outpatient programs like intensive outpatient (IOP) and partial hospitalization (PHP) are typically covered for a set number of visits. This allows patients to live at home while receiving therapy and support.

Medication-Assisted Treatment

Insurance often covers medication-assisted treatment like methadone, Suboxone, or Vivitrol to help manage cravings and withdrawal during recovery.

Therapy and Counseling

Most plans cover some form of individual, group, and family therapy using evidence-based approaches like cognitive-behavioral therapy (CBT).

Mental Health Services

Dual diagnosis treatment for co-occurring mental health conditions like depression, anxiety, or PTSD is often covered by insurance.

The specific services and coverage levels can vary by plan and provider. Verifying insurance benefits is recommended to understand deductibles, copays, and any treatment limitations.

Does insurance cover rehab for alcohol misuse?

Alcohol rehab coverage varies based on the individual’s insurance plan. Most major providers like Cigna and Aetna do offer some level of coverage for alcohol addiction treatment services. This typically includes acute detox, inpatient/residential rehab, outpatient programs, medication-assisted therapy, and counseling.

Verifying Your Benefits

To understand what’s covered under your specific plan, it’s crucial to verify your insurance benefits. Contact your provider, provide details like policy number and treatment needed, and ask about:

- In-network vs. out-of-network coverage levels

- Copays, deductibles, treatment duration limits

- Preauthorization requirements

Exploring All Options

Even with limited coverage, there are ways to make rehab affordable. Many centers like Evoke Wellness offer alternative payment plans, sliding scale fees, and potential scholarships. Their admissions team can guide you through verifying coverage and exploring financial assistance options.

The cost of untreated alcoholism is far greater in the long run. Seeking professional treatment can offset expenses through improved health, productivity, and reduced legal issues. With determination and the right support, recovery is possible.

Is addiction considered a pre-existing condition?

Addiction Under the Affordable Care Act

The Affordable Care Act (ACA) considers substance use disorders, including addiction, as pre-existing conditions that insurance companies cannot deny coverage for. Under the ACA, rehab and other addiction treatment services must be covered by most health insurance plans.

Medical Definition of Addiction

Addiction is recognized as a chronic brain disease characterized by compulsive substance use despite harmful consequences. It involves biological, environmental, and behavioral components that lead to functional impairments and health issues.

Coverage for Addiction Treatment

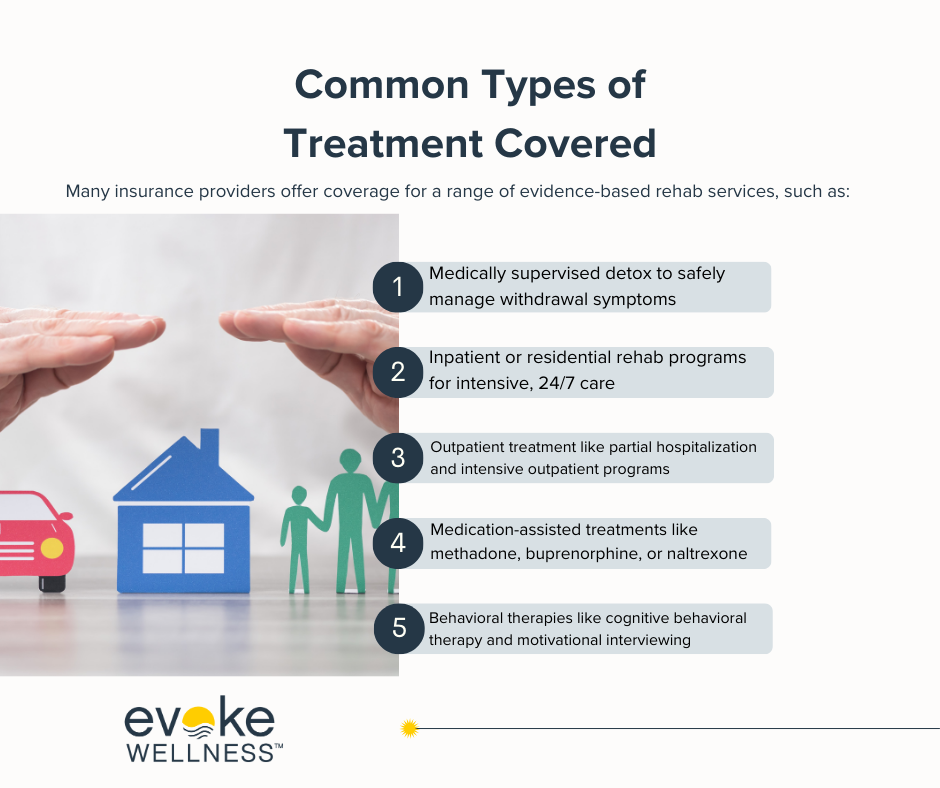

Most health plans must provide coverage for a range of evidence-based addiction treatment services, such as:

- Acute detoxification

- Inpatient/residential rehab programs

- Intensive outpatient treatment

- Medication-assisted therapies

- Individual, group, and family counseling

However, specific coverage details may vary across different insurance policies and providers. It’s crucial to understand your plan’s benefits and limitations regarding addiction treatment.

Statistics on Addiction Treatment Coverage

- According to a 2021 report, approximately 92% of substance abuse treatment admissions were covered by either public or private insurance.

- A study by the National Institute on Drug Abuse found that individuals with insurance coverage were more likely to receive addiction treatment compared to those without coverage.

By recognizing addiction as a pre-existing condition under the ACA, individuals struggling with substance use disorders have greater access to potentially life-saving treatment options through their health insurance plans.

Understanding the importance of insurance coverage for drug rehab in Ohio

In Ohio, having comprehensive insurance coverage for drug rehab is crucial. Addiction treatment can be expensive, often costing thousands of dollars out-of-pocket without insurance.

Covering the Full Continuum of Care

Quality insurance plans should cover the full continuum of evidence-based addiction treatment, including:

- Medically-supervised detox to manage withdrawal safely

- Inpatient or residential rehab programs

- Intensive outpatient treatment

- Aftercare and sober living support

Fighting the Opioid Epidemic

Ohio has been hit particularly hard by the nationwide opioid crisis. In 2020, over 5,000 Ohioans tragically died from drug overdoses – a staggering 25% increase from 2019 according to the CDC.

Ensuring addiction treatment is affordable and accessible through insurance is vital for saving lives and helping more people achieve lasting recovery.

Mental Health Coverage Too

Many people struggling with substance abuse also face co-occurring mental health disorders like depression or anxiety. Look for plans that provide comprehensive behavioral health benefits covering therapy and counseling along with addiction treatment.

Taking the time to understand your insurance benefits can mean the difference between getting life-saving care or continuing to struggle with untreated addiction. Don’t let costs be a barrier – your health is worth it.

Is rehab covered by insurance?

Most major health insurance plans cover at least some portion of addiction treatment costs, including for rehab programs. According to research, individuals with insurance coverage have higher rates of entering and completing treatment, which improves long-term recovery outcomes.

Verifying your coverage

The extent of coverage can vary depending on your specific insurance plan. To understand your benefits:

- Contact the treatment center directly to verify what services are covered under your policy

- Use online tools to input your insurance details and check approved providers

- Review your plan documents for substance abuse treatment coverage details

Cigna and United Healthcare are among the major insurers that provide comprehensive addiction treatment coverage across inpatient, outpatient, and medication-assisted programs.

Exploring alternative payment options

For those without insurance or limited coverage, many rehab facilities offer flexible payment plans:

- Self-pay options at discounted rates

- Income-based sliding scale fees

- Partial scholarships or financing assistance

The admissions team can help explore solutions to make high-quality care accessible.

Conclusion

In conclusion, navigating insurance coverage for drug and alcohol rehabilitation can be complex, but understanding your options is crucial. Remember that most insurance plans provide some level of coverage for substance abuse treatment, including acute detox, residential care, and outpatient programs. Be proactive in researching your specific policy and communicating with your insurance provider. Don’t let concerns about cost prevent you from seeking the help you need. With the right information and support, you can access the appropriate level of care to begin your journey to recovery. Ultimately, investing in your health and well-being through rehab is one of the most important decisions you can make for yourself and your loved ones.

Begin Your Journey with Evoke Wellness at Cohasset

If you or a loved one is considering treatment, Evoke Wellness at Cohasset invites you to contact us. Our compassionate team is ready to answer your questions, discuss your needs, and help you take the first steps toward recovery. In Cohasset, you’ll find more than just a treatment program – you’ll discover a community dedicated to your wellness and success. Together, let’s embrace the journey to recovery and the promise of a new beginning. Call us at (617) 917-3485 today or reach out online.